What Does Guided Wealth Management Do?

Table of ContentsIndicators on Guided Wealth Management You Need To KnowWhat Does Guided Wealth Management Mean?How Guided Wealth Management can Save You Time, Stress, and Money.The Definitive Guide for Guided Wealth ManagementGuided Wealth Management for Beginners

The consultant will establish up an asset allotment that fits both your risk tolerance and risk capacity. Asset allocation is just a rubric to establish what percentage of your complete economic profile will certainly be dispersed throughout numerous property classes.

The ordinary base salary of an economic advisor, according to Without a doubt since June 2024. Note this does not include an approximated $17,800 of annual payment. Anyone can collaborate with an economic advisor at any age and at any kind of phase of life. financial advisor redcliffe. You do not need to have a high net well worth; you just have to discover an advisor fit to your circumstance.

A Biased View of Guided Wealth Management

If you can not manage such aid, the Financial Planning Organization might be able to assist with for the public good volunteer assistance. Financial consultants help the client, not the company that utilizes them. They ought to be receptive, eager to describe economic principles, and maintain the customer's best interest at heart. If not, you must search for a new advisor.

A consultant can recommend possible enhancements to your plan that might aid you accomplish your objectives extra successfully. If you do not have the time or rate of interest to handle your finances, that's another great reason to employ a monetary advisor. Those are some general reasons you could require an advisor's professional assistance.

Seek a consultant that concentrates on educating. An excellent monetary advisor should not just offer their services, yet offer you with the devices and sources to end up being monetarily savvy and independent, so you can make enlightened decisions by yourself. Choose an expert who is educated and knowledgeable. You desire an advisor who stays on top of the monetary scope and updates in any kind of location and that can address your economic inquiries regarding a myriad of topics.

Rumored Buzz on Guided Wealth Management

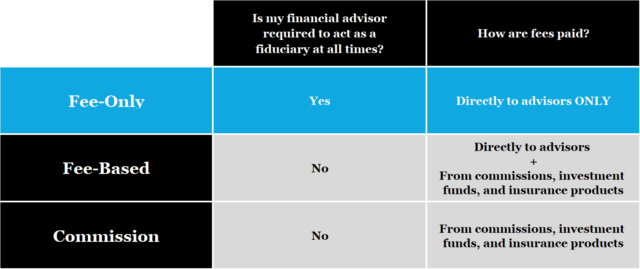

Others, such as licensed monetary coordinators(CFPs), currently stuck to this criterion. Under the viability requirement, economic advisors normally work on payment for the products they offer to clients.

Charges will certainly also differ by area and the advisor's experience. Some consultants might provide reduced rates to aid clients that are simply getting going with financial preparation and can not afford a high month-to-month rate. Commonly, a financial expert will use a cost-free, initial appointment. This consultation supplies a chance for both the client and the advisor to see if they're a great fit for each other - https://guided-wealth-management.mailchimpsites.com/.

A fee-based advisor may gain a charge for creating a monetary strategy for you, while also gaining a payment for marketing you a specific insurance coverage item or financial investment. A fee-only financial advisor gains no commissions.

What Does Guided Wealth Management Mean?

Robo-advisors don't need you to have much money to get going, and they cost much less than human monetary advisors. Instances include Improvement and Wealthfront. These services can save you time and possibly cash as well. Nevertheless, a robo-advisor can not talk to you concerning the very best way to leave debt or fund your kid's education.

An expert can assist you figure out your cost savings, how to develop for retired life, aid with estate planning, and others. Financial experts can be paid in a number of methods.

How Guided Wealth Management can Save You Time, Stress, and Money.

Marital relationship, separation, remarriage or merely moving in with a brand-new companion are all turning points that can require mindful preparation. As an example, together with the usually hard emotional ups and downs of divorce, both companions will have to handle essential financial factors to consider (https://www.ted.com/profiles/47401410/about). Will you have adequate income to support your lifestyle? Just how will your financial investments and various other possessions be divided? You may really well require to change your monetary approach to keep your objectives on track, Lawrence says.

An abrupt influx of money or assets increases prompt questions about what to do with it. "A financial consultant can help you analyze the methods you can place that cash to pursue your personal and economic objectives," Lawrence states. You'll intend to think of just how much could most likely to paying for existing debt and how much you could consider investing to pursue a much more secure future.